Taxes

The Tax Tables program is used to define taxes required to charge to your customers. The Tax Jurisdictions program is used to define all of the tax situations encountered when billing your customers. Each situation is called a jurisdiction. Also see Tax Reports.

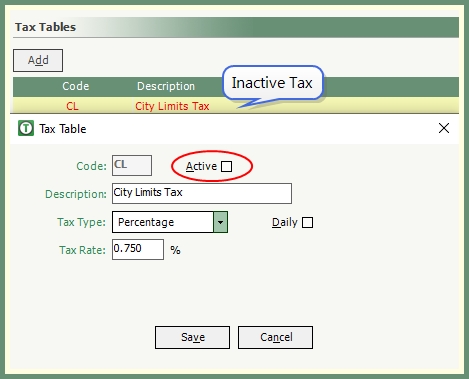

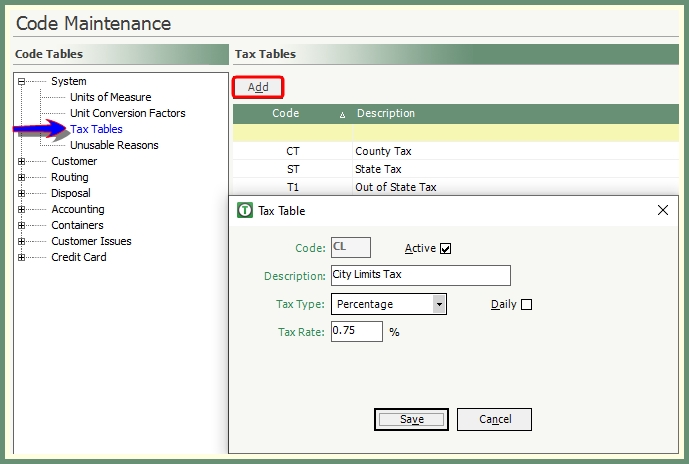

Navigation: System>Configuration>Code Tables>System>Tax Tables

- Click Add to create a new tax code to the table or double click to recall an existing tax.

- Enter a unique 2-digit Code.

- Active will be set by default.

- Taxes cannot be deleted but can be made Inactive by removing the Active setting. Inactive taxes will display in the table in .

- Enter a unique tax Description.

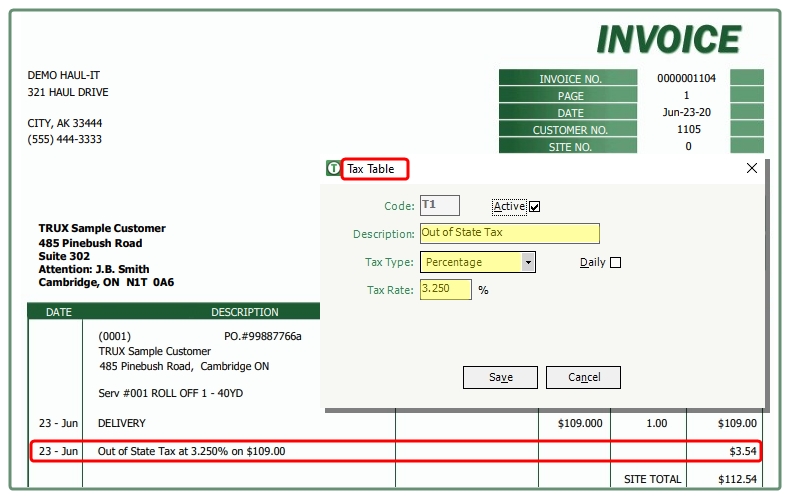

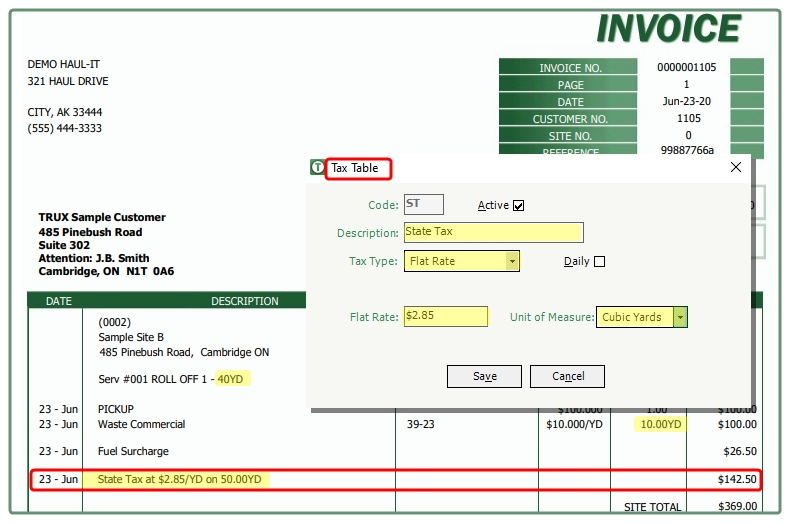

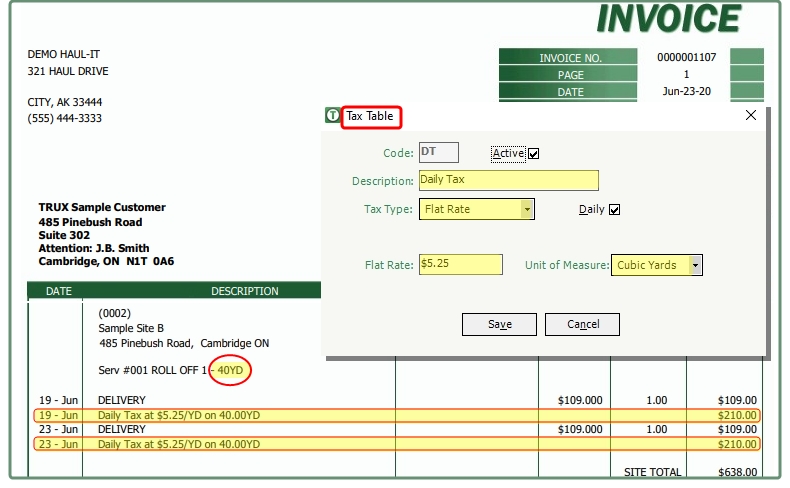

- Select a Tax Type. This is the calculation method to be applied to taxable items.

- Percentage: A Percentage Tax is calculated as a percentage of the value of the

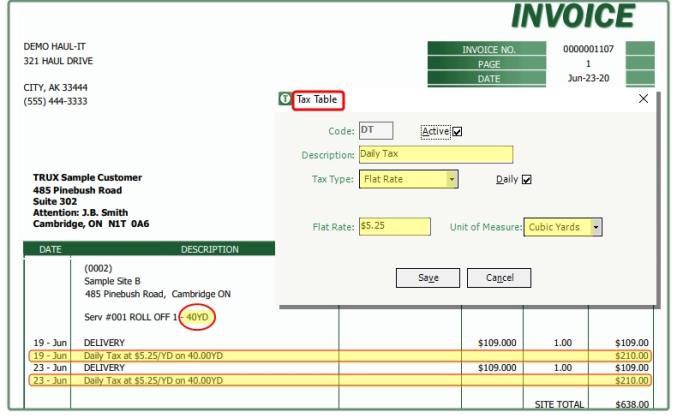

- Flat Rate: A Flat Rate Tax is calculated as the tax rate multiplied by the quantity of the selected unit of measure of the .

- Daily: A Daily Tax is a per item tax per day based on the Tax Type and Rate .

- Save and Repeat for as many Taxes as required.

- Proceed to apply taxes to Activities and Material/Commodities.

- Proceed to Tax Jurisdiction to apply taxes per jurisdiction.

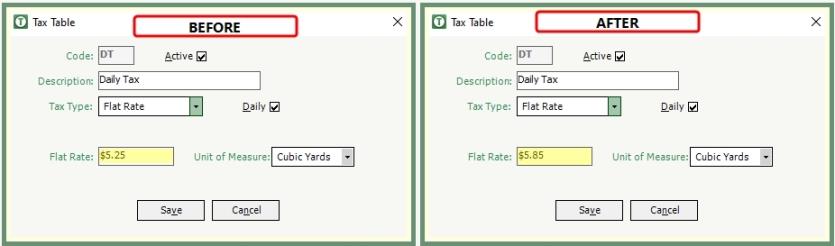

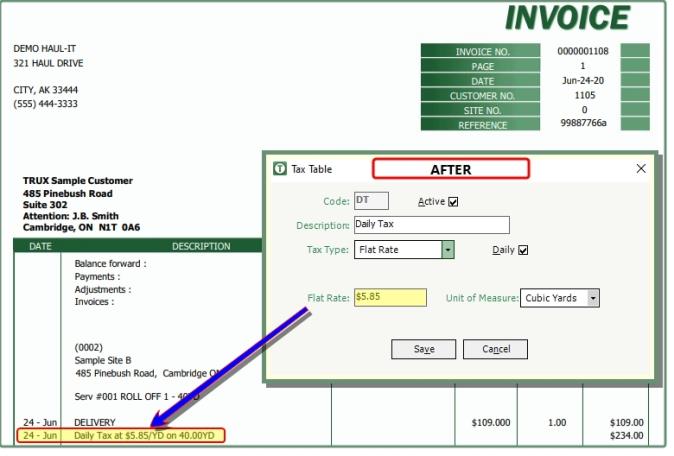

Tax Rates do not have an effective date, therefore the tax rate at the time of billing is what will be applied to taxable items. If there is a tax rate change, it is recommended the tax rate be updated after all billing for the previous tax rates are completed before entering the new tax rate.

- Complete all billings at the previous tax rate .

- Update the Tax Rate in the .

- Billings generated after the tax rate has been updated, all taxable items will calculate based on the updated .

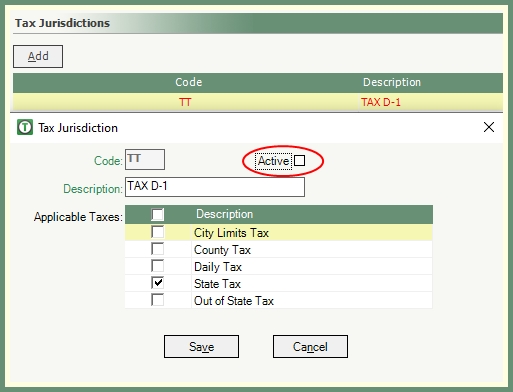

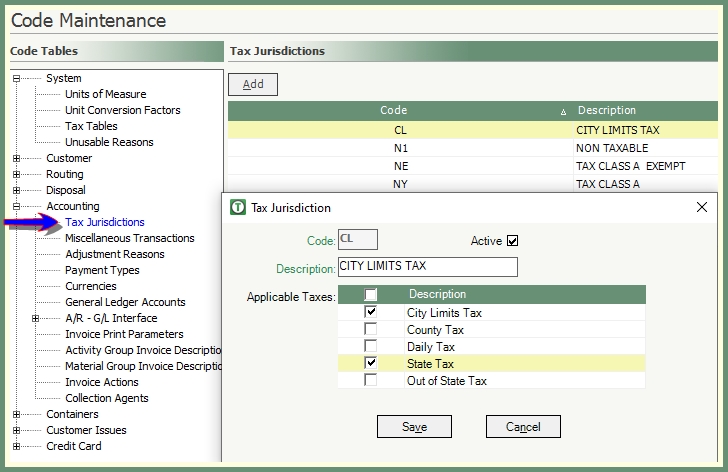

- Click Add to create a new Tax Jurisdiction or double click to recall and modify an existing.

- Enter a unique 2-digit code.

- Active will be set by default.

- Tax Jurisdictions cannot be deleted but can be made Inactive by removing the Active setting. Inactive taxes will display in the table in .

- Enter a unique Description.

- Select the Taxes to be applied to this Tax Jurisdiction.

- Save and Repeat for as many Tax Jurisdictions as needed.

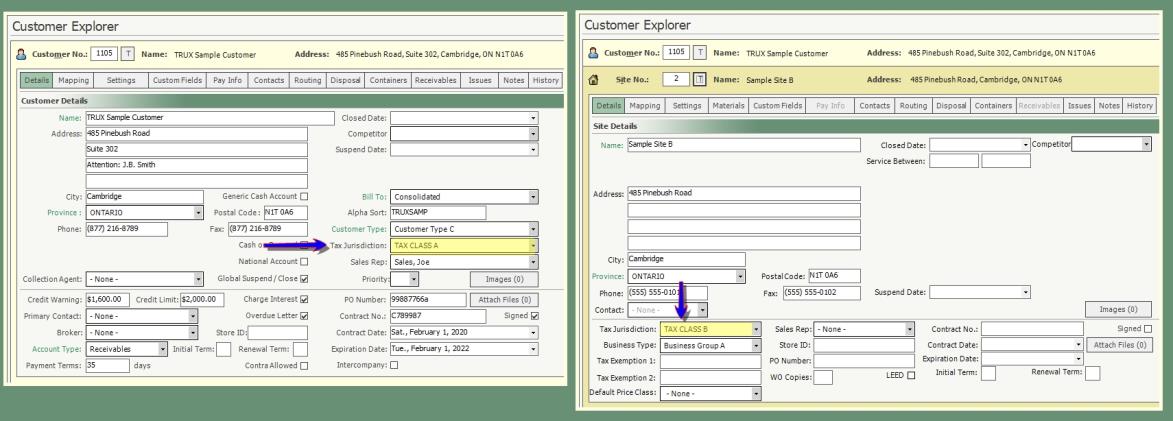

- Proceed to Customer to apply a Tax Jurisdiction to the .

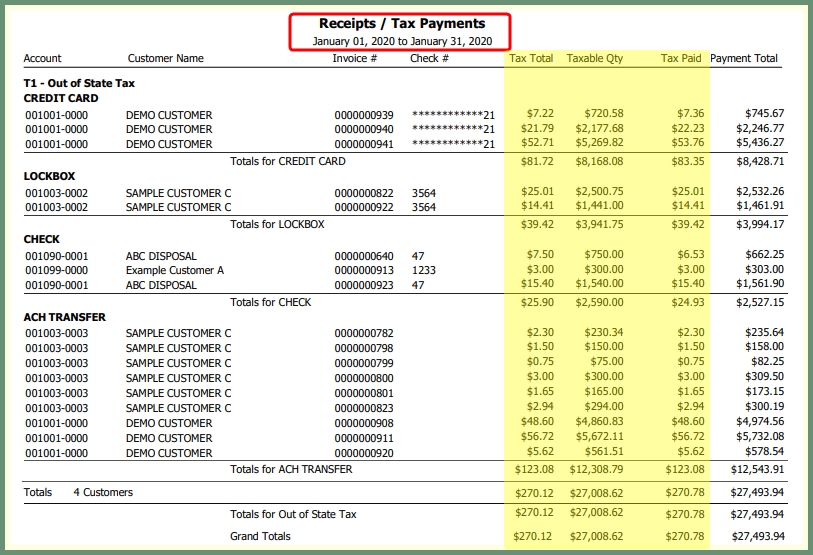

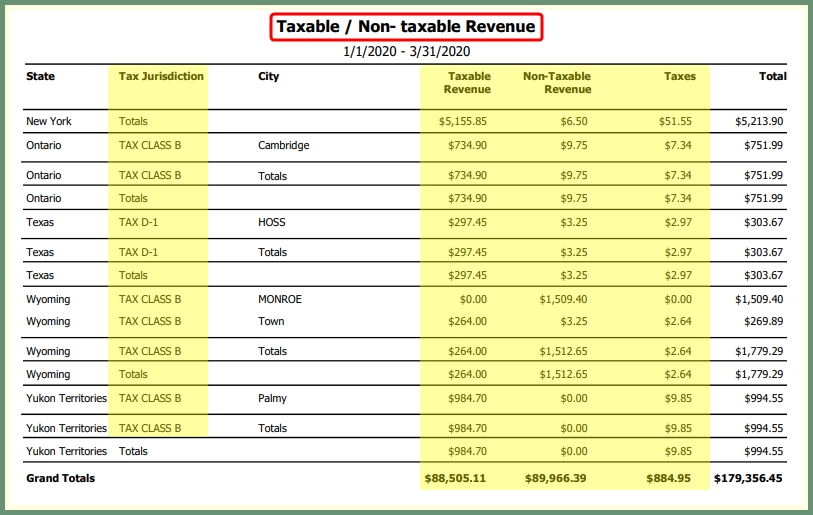

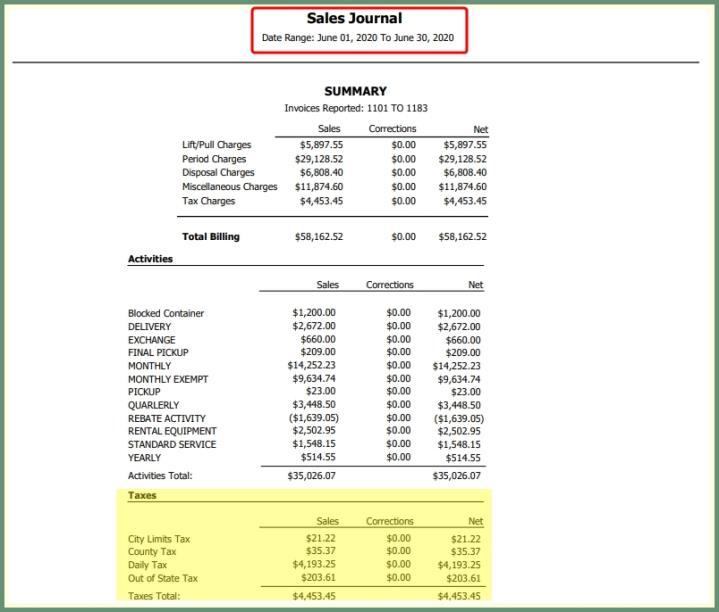

Navigate To: Report>Report Center>Accounting